Author: Baye Alioune SAMB, economist, PHD

BSTRACT

This essay presents an econometric study on the relationship between foreign direct investment and economic growth in Senegal. The study of the impact of foreign direct investment has been approached in previous essays through a review of the theoretical literature and an analysis of stylized facts both at the macroeconomic and mesoeconomic levels.

This essay attempts to specifically quantify the macroeconomic impact of FDI and economic growth in Senegal using an error correction model to determine the nature and extent of the correlation between these two variables.

Thus the following hypothesis was tested: foreign direct investments in Senegal do not have a significant impact on economic growth. After estimation of the model parameters by the Cochrane Orcutt method, the short-term dynamics of the model linking these two variables, reveals that if FDI increases by one (01) point, economic growth decreases for a value between -

0.86 and - 0.016. However, the impact of FDI on economic growth is positive in the long term.

INTRODUCTION

This essay presents an econometric study on the relationship between foreign direct investment and economic growth in Senegal. The study of the impact of foreign direct investment has been approached in previous essays through a review of the theoretical literature and an analysis of stylized facts both at the macroeconomic and mesoeconomic levels.

Thus, even if this macroeconomic approach has provided a general overview of the effects of FDI on the external balance; and job creation, economic growth in Senegal. However, the essay1 failed to draw a firm conclusion on the nature and extent of the correlation between FDI and economic growth. On the other hand, the second essay on the meso-economic analysis of FDI in the telecommunications sector in Senegal highlighted through the analysis of stylized facts a very significant effect of FDI on Senegal's GDP. Given the economic weight that the telecommunications sector represents in the Senegalese economy, the result of the mesoeconomic analysis of FDI gives indications on the intuitive sign of the elasticity of Senegal's gross domestic product in relation to investments direct foreigners.

The new theory on endogenous growth provides theoretical foundations for a significant correlation between economic growth and foreign direct investment mainly through the channel of technology transfer. The depth of this technological channel which is becoming increasingly important in the context of a global economy increasingly based on knowledge and technological innovation.

Technological innovation results from the products of research and development that allow the creation of new processes or production processes, finals products or intermediates, or the invention of better quality products. Based on these mechanisms, the economic literature distinguishes two families of models on endogenous growth, namely the expanding Variety Models developed by authors such as Rivera-Batizet Romer, (1990,1991);and models of competitive innovation notably with (Schumpeterian growth models; Aghion and Howitt (1992, 1998), Grossman and Helpman (1991)).

Through the theory of endogenous growth with knowledge externalities, Romer (1991), puts at the center of the activity of innovation, the endowment of qualified personnel. With the development of research and technological innovation, investments increasingly incorporate significant technological value. This naturally implies lifelong learning at the level of human resources, strengthening their capacity to adapt to changing technology and to new and increasingly sophisticated working methods. Foreign direct investments are particularly characterized by capital intensive activities and incorporate high technological value. They also constitute a vector for the profitability of accumulated capital and research and development products. FDI thus allow the exploitation of invention patents and licenses. In other words, FDI is both a financial instrument and a valuation of research and development. Thus, the productivity of the labor factor naturally improves as a result of FDI due to the transfer of technology that they ensure.

The relationships between economic growth, foreign direct investment, technology transfer and human capital have been represented by several authors, notably Borensztein et al. (1998) who showed that FDI has a positive impact on GDP, and specifies that the size of the effect depends on the level of human capital. In the same vein, Xu (2000) finds that FDI brings technology and leads to higher economic growth than when the host country reaches the minimum threshold of human capital. But it should be noted that economists have long recognized the importance of investing in human beings since at least the pioneering work of Mincer (1958,1974), Shultz (1961) and Becker (1962). Spending on education, vocational training, labor migration and health care helps to increase the quality of the workforce and increase the productivity of human resources.

In Senegal, there is a strong presence of FDI in the tertiary sector which is the engine of economic growth. The post and telecommunications branch contributes significantly to the dynamism of the sector. As a reminder, the contribution of the post and telecommunications sector to growth is around 0.68% for an average economic growth of 3% in 2012. The telecommunications sub-branch is characterized by a strong presence subsidiaries of multinational telecommunications companies, which naturally have high-tech production processes. However, Senegal, as in most developing countries, is characterized by a level of qualification that is far insufficient of its human capital. This could mitigate the positive effect of FDI on economic growth.

We will specifically attempt to provide an answer to the following research question: What is the impact of FDI on economic growth. The main research objective is to quantify the effect of foreign direct investment on economic growth in Senegal through an econometric study. In other words, it is a question of determining the elasticity of the GDP in relation to the net flows of FDI in Senegal. The following hypothesis: foreign direct investments in Senegal do not have a significant impact on economic growth. The study of the relation FDI and economic growth will be analyzed using the error correction model.

This essay is made up of two chapters:

- The first chapter which presents the specification of the model

- The second chapter presents the estimates and interpretation of the results of the model

1 : MODEL SPECIFICATION

This chapter presents the specification of the model likely to estimate the relationship between economic growth and foreign direct investment in Senegal.

1 -1 : PRESENTATION OF MODEL VARIABLES

This section presents the model variables: the explained variable or endogenous variable and the exogenous variables of the model or explanatory variables.

The specification of the economic model is as follows:

- Endogenous variable: Gross domestic product in volume (GDP vol) of Senegal

- Exogenous variables: Gross public fixed capital formation in volume (GFCFgvol); net flows of foreign direct investment (FDI) and exports in volume (EXPORT vol) from Senegal.

Thus the error correction model D(PIBtvol) = a1 + a2 D(FBCFgtvol) + a3 D(IDEt) + a4D(EXPORTtvol) + a5 PIBt-1vol + a6 FBCFgt-1vol+ a7 IDEt-1vol

+a8 EXPORTt-1vol +AR(2) +ut (AR : Autorégressif)

“Standard endogenous growth theory highlights four engines of growth in an economy: Private Capital: Models of Romer - Rebelo [1986, 1991]; Public Capital: Barro's Model [1990]; Technological Capital: Romer's Model [1990]; augmented by Aghion - Howitt [1992]; Human Capital: Lucas Model [1988].

Thanks to the fusion between the theory of endogenous growth and the new theory of international trade, work was focused on the ways in which openness influences economic growth ... (Lemzoudi, 2005)

Gross fixed capital formation is a component of public expenditure. Drawing on the work of Barro (1990) on endogenous growth models with public capital; gross public fixed capital formation can be considered as a candidate factor in the analysis of economic growth in Senegal. According to

S. Charlot (1999) “endogenous growth models with capital externalities (Barro,

1990) are most often based on production functions with three production factors, namely labor, private capital and infrastructure. According to Barro (1998; 1990) “production is stimulated by private investment and public spending; the growth rate and the savings rate increase with the increase in the share of public expenditure on GDP ". These models show the role played by public investment, i.e. the accumulation of public capital, in growth: public infrastructure (roads, airports, public lighting, water distribution network, etc. ) in the development of the productivity of private agents and consequently economic activity in general.

Foreign direct investment is likely to stimulate four main engines of economic growth in the host country, namely private capital, public capital, technological capital, human capital, in particular through transfers of financial capital, and technology at the host country level. Indeed, “foreign investors in many countries have largely participated in infrastructure development. (OECD, 2005). Nowadays, public-private partnerships are increasingly sought after by States to finance infrastructure projects. They are also an essential vector of foreign direct investment (FDI).

The impact of technological capital on economic growth has also been shown by several models including that of Romer [1990]; augmented by Aghion - Howitt [1992]; (Grossman and Helpman (1991). Most of these models place Research and Development (R&D) and technological innovation at the heart of the analysis of the process of economic growth. Faced with the difficulty of establishing a national innovation system, developing countries are exploring and exploiting the channels of the internationalization of knowledge, including FDI (foreign direct investments) to attract the technologies necessary for economic development.

The internationalization of research and development activities is a rather recent phenomenon and today largely driven by the behavior of MNCs in developed countries, which has changed the aspect of national private R&D dynamics, or of national innovation systems. Also considered a sensitive

activity for a long time, R&D is undoubtedly the function of the value chain of firms which was most recently affected by internationalization. FDI is therefore one of the vectors for the international transfer of knowledge. Some authors assimilate it to a block of knowledge or technology

The internationalization of technology or research & development is in fact characterized by:

- An increase in technological exchanges. According to (Hugel,1981) “technological exchanges are made up of four main components, namely the exports of technology-intensive products (TDT); sales of patents, licenses and know-how; direct investments; and technical assistance ”.

- An increase in R&D spending by subsidiaries of multinational firms - This involves R&D spending by foreign subsidiaries of firms as well as R&D contracts for the benefit of third parties residing abroad.

Les comportements de localisation des actifs de connaissances des FMN sont également fortement influencés par la dotation de l’économie d’accueil en ressources humaines de qualité. Selon Wang (1990) l’IDE est plutôt attiré par un pays où prévaut une forte rentabilité du capital, qui est doté d’une main d’œuvre qualifiée et qui dispose d’un système d’innovation développé et structuré.

The localization behaviors of knowledge assets of MNCs are also strongly influenced by the endowment of the host economy with quality human resources. According to Wang (1990), FDI is rather attracted to a country where there is a high return on capital, which is endowed with a skilled workforce and which has a developed and structured innovation system.

The impact of human capital on economic growth has been demonstrated by the Lucas Model (1988). It also happens that this concept is largely prior to the new theories of growth, it is in fact borrowed from Walsh (1935), and from the theories of human capital developed in the 1960s by Schultz (1961), Mincer (1962), or Becker (1962). Uzawa (1965), Lucas (1988), and Romer (1990) stress "the importance of human capital as the crucialdeterminant in the growth process". (Jlidi, 1996).

According to Lucas (1988), “education is at the heart of the growth process because knowledge is considered according to an individual logic, it is incorporated into individuals as human capital… the production of human capital by the education system would induce sustained economic growth ”.

According to (Yoshua, 2007) “FDI can significantly contribute to increasing the stock of knowledge in the host country, not only by providing new capital goods and new production processes (incorporated technical changes ), but more, by offering new management know-how and improving the level of qualification that can be disseminated to local firms (disincorporated technical changes). The improvement of qualification can take place through formal training of workers or through “Learning by doing” within foreign subsidiaries. FDI, by improving the host country's knowledge stock, will have both a short- term and a long-term effect on the host economy, and increases the long-term growth rate. Romer, stipulates that multinational firms, by providing new knowledge to developing countries, reduce the technological gaps between these countries and the advanced countries, which can constitute an important factor of growth and economic convergence ”.

The export variable is chosen as an indicator of trade openness, a factor likely to explain fluctuations in economic growth in Senegal, given the theoretical and empirical arguments advanced by a large number of economists on the impact of foreign trade on economic growth on the one hand and Senegal's degree of trade openness on the other.

International trade makes it possible to increase the productivity of a country through the imitation or transfer of foreign production techniques. Many authors have shown the link between growth and foreign trade, in particular "Dollar (1992); Ben David (1993); Sach and Warner (1995), Edwards (1995); Krueger (1997) and Frankel and Romer (1999) ”. In addition to studies by “Kindleberger (1962); Caves (1961); Corden (1971); Johnson (1971), Romer

(1990, 1991, 1994); Grossman and Helpam (1991); Balwin (1992); Ruffin

(1993), Easterly, King, Levine and Robelo (1994) "support the argument that open economies outperform protectionist countries".

Dollar (1992), Barro and Sala-I-Martin (1995), Sachs and Warner (1995), Edwards (1998) and Greenaway et al. (1998), using cross-sectional regressions, found that the distortions due to state intervention in trade lead to low growth rates. Ben-David (1993) and Sach and Warner (1995) have also shown that it is only in open economies that unconditional convergence can be observed. Sach and Warner (1995) found that countries with open policies grew at a rate of 4.5% per year in the 1970s and 1980s, and that in contrast, relatively closed countries had a growth rate of only 0.7%. They note, however, that a robust relationship is difficult to find and justify. (Lemzoudi, 2005)

Frankel and Romer (1999) use an instrumental variable method including geographic characteristics, and confirm that international trade has an important and significant impact on growth. Harrison (1996) comes to similar conclusions using a variety of indicators of openness. Using different estimation methods (cross section, fixed effects, five-year average, first differences), the results obtained suggest a positive relationship between the degree of openness and growth. However, not all opening measures were significant, despite the fact that most of them were positive. (Lemzoudi, 2005).

1- 2 : EXPOSÉ SUR LE MODÈLE À CORRECTION D’ERREUR

"Most of the statistical properties of estimation methods apply to stationary variables, that is, non-trend and non-stationary variables. It poses formidable problems insofar as most economic series are trend. This is the case with virtually all macroeconomic series ". In other words, "if all the variables involved in our model are stationary which is extremely rare in practice especially with macroeconomic variables, we can use a general linear model or a time-lag model or others. But if at least one variable is on-trend and therefore non-stationary confirmed by a stationarity test, then the co- integration hypothesis of the variables is checked in order to establish the error-correction model, if necessary ". (Doucouré, 2003-2004)

- Stationarity theory and unit root tests

Definition of stationarity: an Xt process is stationary if the following conditions are true:

• E (Xt) is independent of t

• Var (Xt) is a finite constant independent of t

• Cov (Xt Xt-1) is a finite function of k not depending on t

Consider a given variable X, following a random walk:

By expressing it in the form Xt = Ѳ Xt-1 + εt (1)

Let LXt = Xt-1 (L is a lag operator such that Li Xt = Xt-i with i = 1, 2,3, 4,… ..) Expression (1) becomes Xt = Ѳ LXt + εt (2) by substituting LXt for Xt-1.

Thus (2) Xt = Ѳ LXt + εt can be expressed in the form Xt - ѲLXt = εt or that (1- Ѳ L) Xt = εt

Let us state the condition so that the process is stationary:

If (1-Ѳ L) = 0 that is to say Ѳ L = 1, the expression L = 1 / Ѳ is called the root of the variable. If now L = 1 = 1 / Ѳ then we have a unit root so it is not stationary.

So if Ѳ = 1 then the process is nonstationary then Xt = LXt + εt.

Xt - LXt = (1-L) Xt with 1-L = Δ which the operator is the first difference (1st) Indeed the variable is not stationary because when we proceed by induction for the variable, we have:

With Ѳ = 1, Xt = Xt-1 + εt If t = 1 X1 = X0 + ε1

If t = 2 X2 = X1 + ε2

… ..

Xt = X0 + ∑ εi i ranging from 1 to t

This process is non-stationary because we have: Var (Xt) = Var (∑ εi) = ∑Var (εi) = tб2

NB: structural hypothesis E (εi) = 0 and Var (εi) = б2 (the errors are homocedastic).

In other words, the variable is integrated of order 1 or I (1). In other words, it suffices to differentiate it only once to make it stationary. In practice most of the series are integrated of order 1, that is to say stationary in first difference. Rarely we get an order of integration greater than or equal to three (03).

The stationarity test is also called the unit root test. The more common tests of unit root (in English it is called Unit root test) are the tests of Dickey Fuller, Dickey Fuller augmented (or Phillip Perron).

-  Theory on the cointegration test

Theory on the cointegration test

The theory of cointegration makes it possible to specify the conditions under which it is legitimate to work on non-stationary series. The nonstationary variables can be combined to obtain an error correction model that is an economically stable and interpretable relationship. Non-stationary terms are interpreted as elements of a long-term equilibrium. "(Doucouré, 2003-2004) Definition of cointegration:

Two non-stationary series Xt and Yt each integrated of order 1 or I (1) if we have:

If the linear combination Yt –aXt –b = εt, is integrated of order 0 or I (0). In general, if Xt and Yt are two series I (d), the linear combination may not be I

(d) but (I (d-b) with b a strictly positive integer (b≤d)

The series are then cointegrated. (Xt and Yt are then cointegrated of order (d,

b) or CI (d, b)

- General expression of the error correction model

D (Yt) = β0 + β1 (DX1t) + β2D (x2t) +…........................................................ βkD (xkt) + γ0Yt-1 + γ1X1t-1 +

γ 2 X2t-2 +.............. + γ kXkt-k + εt

β1, β2,… .βk represent the short-term dynamics

γ1, γ 2, ……… γ k represent the long-term dynamics γ0 represents the error correction coefficient (γ0 ≤0)

The most common cointegration tests are the Angle granger test, the Johansen test.

- Estimation of the model parameters

The estimation of the parameters of the error correction model can be done by the ordinary least squares method if the conditions of application of the said method are verified, namely the structural and stochastic assumptions:

H1: Number of observations (n) must be greater than the number of parameters (k)

H2: the explanatory variables must be independent, i.e. uncorrelated or non collinear

H3: errors are uncorrelated or independent

H4: the errors have the same variance (homoscedastic)

H6: the errors according to a normal distribution of parameters E (εi) = 0 and Var (εi) = б2 If there is a correlation of errors, the Cochrane-Orcutt method can be used.

- Model validation test

The validation tests most often performed are: the student test, the Fischer test, the error correlation test, the homocedasticity test,....................................... to check whether

the estimates are optimal.

- Statistical inference: estimate by confidence interval

The following expression was used to estimate the parameters: âi -ta sâi £ ai£ âi -ta sâi

- Experimental design of the error correction model

Step1: Economic modeling It is a question of choosing the different variable (endogenous and exogenous) involved in the model linking GDP and foreign direct investment. The choice of variables is guided by economic theory on growth and on FDI (cf. review of the literature). D (PIBtvol) = F (FBCFgtvol, EXPORTtvol, IDE) GDP theft: gross domestic products in volume GFCF: gross fixed capital formation in volume Export: export in volume FDI: net flow of foreign direct investment

Step 2: formulation of the econometric model D (PIBtvol) = a1 + a2 D (FBCFgtvol) + a3 D (IDE) + a4D (EXPORTtvol) + a5 PIBt-1vol + a6 FBCFgt- 1vol + a7 IDEt-1vol + a8 EXPORTt-1vol + AR (2) + ut Ut: model error AR (2): autoregressive of order 2

Step 3: collecting data relating to the model variables The database is made up of statistics published by ANSD and the Central Bank (see appendix 1). The time series expressed in volume relate to the period 1985 to 2008.

Step 4: Test the stationarity of the model variables The Dickey Fuller Augmented test is used through the Eviews software.

Step 5: Cointegration test The Johansen test is used with the Eviews software.

Step 6: Estimation of the model parameters

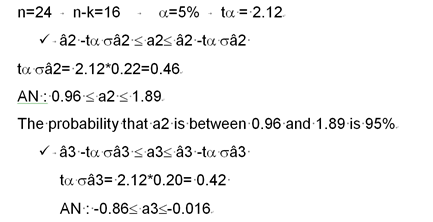

The estimation of the model parameters is carried out by the method of Cochrane Orcutt. An estimate by confidence interval is carried out on the parameters characterizing the short-term dynamics. The model parameters were also estimated using a 5% threshold confidence interval.

Step 7: Model validation tests

The validation tests carried out are: the fuller Dickey test, the Johansen test, the test of significance of the variables (Student's test), the test of global significance (Fischer test), the test of homocedasticity of errors, the error correlation test.

2 : ESTIMATES AND INTERPRETATIONS OF THE RESULTS

This chapter presents estimates of the relationship between economic growth and foreign direct investment in Senegal.

2- 1: ESTIMATES AND TESTS

This section presents the model validation estimates and tests.

- Estimates of model parameters

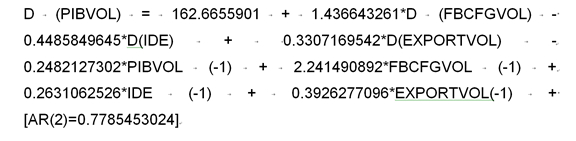

After estimations of the parameters of the model we have the following model: Substituted Coefficients:

Table1: model coeffcients

|

short-term dynamic |

Long-term dynamics |

FBCFG |

1.43 |

9.03 |

IDE |

-0.44 |

1.06 |

Export |

0.33 |

1.57 |

The confidence interval estimate at the 5% threshold gives the following results:

The probability that a3 is between -0.86 and -0.016 is 95%

- Model validation tests

Stationarity and Co-integration test (see Appendix)

The value and sign of the error correction coefficient

The error correction coefficient - 0.2482127302, it is negative and significantly different from 0.

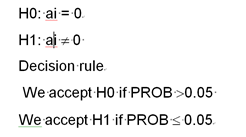

Significance test of the variables (Student)

Global significance test (Fischer)

F-statistic = 17.6769375108

Prob (F-statistic) = 1.56269578446e-05

Homocedasticity test

We test the hypotheses H0: homocedastic errors H1: heterocedastic errors Decision rule

If the two probabilities are greater than 0.05 we accept H0 If the two probabilities are less than 0.05 we accept H1

Table 2: white tests results

White Heteroskedasticity Test: |

F-statistic |

1.22307740536 |

Probability |

0.42588240967 5 |

Obs*R-squared |

15.5508997947 |

Probability |

0.34156200966 8 |

Errors are homocedastic

Test de corrélation des erreurs

On teste les hypothèses

H0 : erreurs non corrélées

H1 : erreurs corrélées